Renters Insurance in and around Bellingham

Your renters insurance search is over, Bellingham

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Ferndale

- Lynden

- Blaine

- Whatcom

- San Juan

Insure What You Own While You Lease A Home

Think about all the stuff you own, from your bed to dresser to boots to golf clubs. It adds up! These personal items could need protection too. For renters insurance with State Farm, you've come to the right place.

Your renters insurance search is over, Bellingham

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

Renting a home is the right decision for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover damage to the structure of your rented home, but that doesn't cover the repair or replacement of your belongings. Renters insurance helps guard your personal possessions in case of the unexpected.

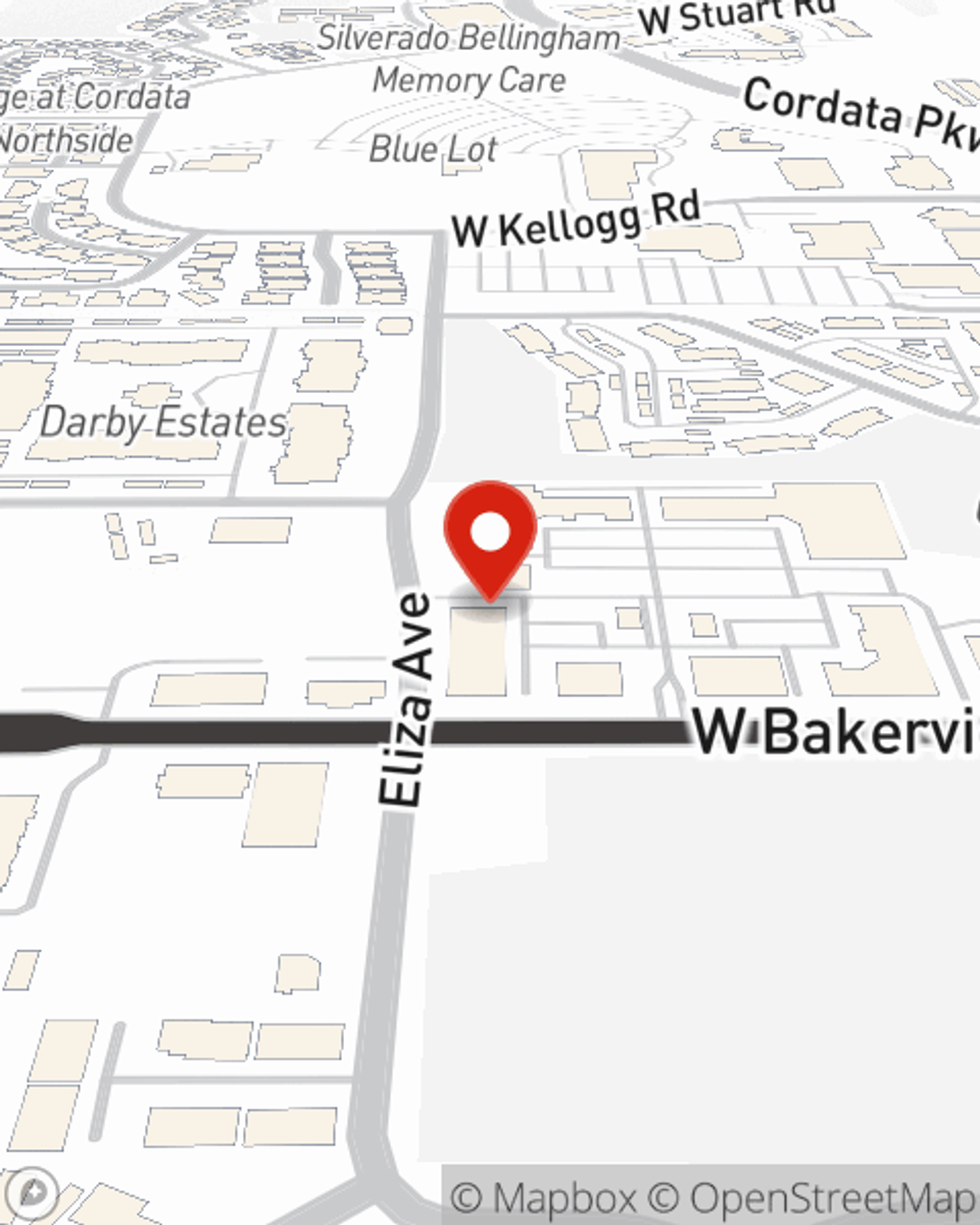

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Bellingham. Reach out to agent Terry Stach's office to learn more about a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Terry at (360) 389-5938 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Terry Stach

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.